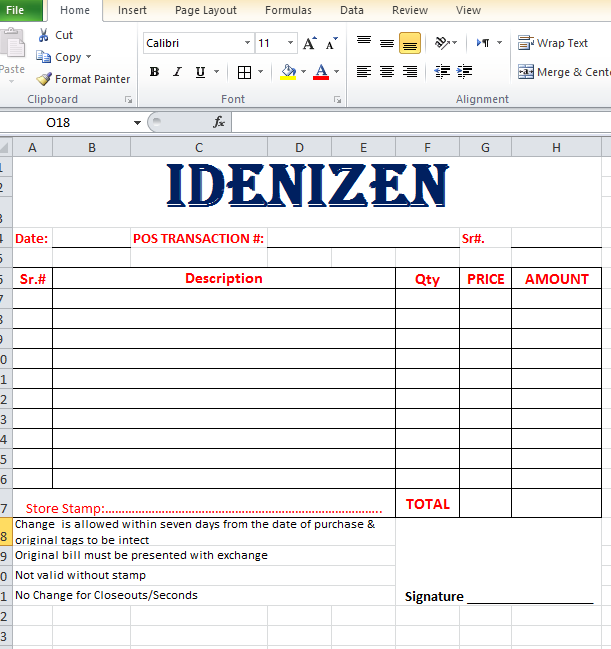

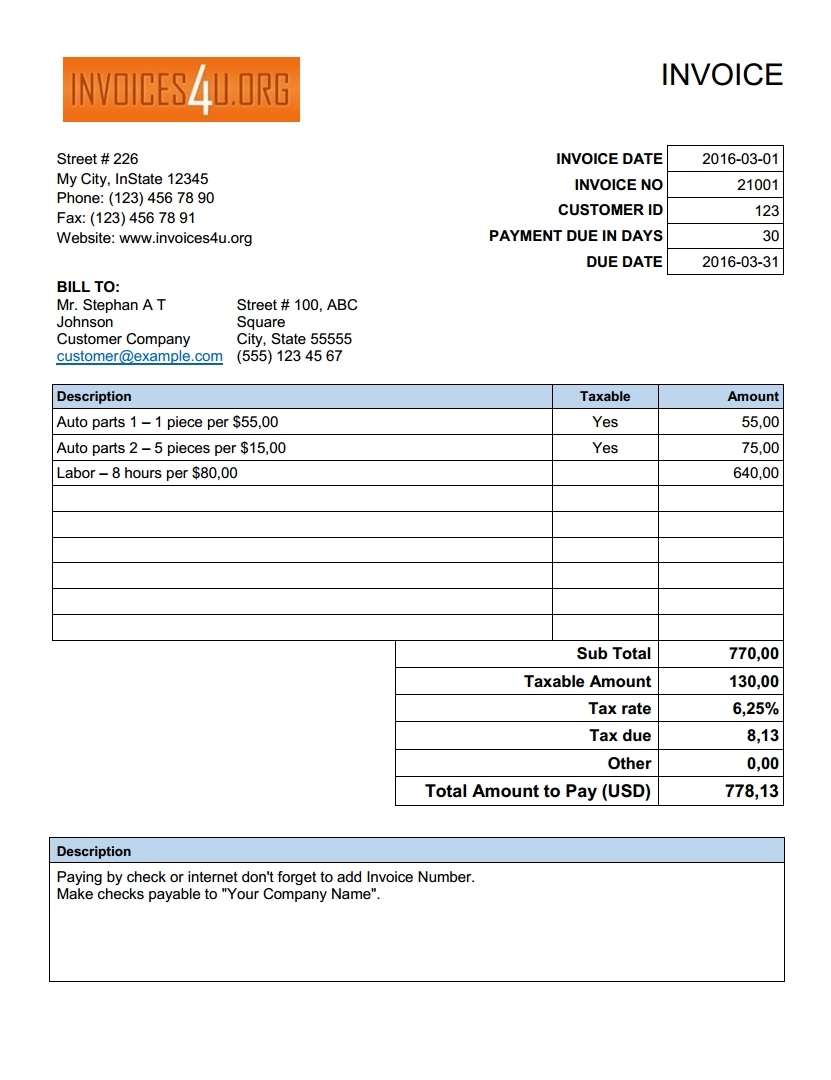

Similarly, you can use PRODUCT and SUM formulas to calculate the total price of the items and the total invoice amount.ĭisadvantages of Using Excel for Invoice FormatsĮven though MS-Excel is one of the easy options for invoice generation, its use is limited to the initial phases of the business. For instance, the ‘Date field’ can be auto-filled with the current day’s date using the formula =TODAY(). You can also insert some excel formulas to auto-populate the cells when creating invoices. Step:9 – At the bottom of the page, provide your bank details and other payment modes like UPI bar code, UPI ID, or UPI phone number. Step:8 – Right below the ‘Invoice To’ section, create the ‘Goods or services ’ section to enter data, including name of the product/service, quantity, tax rate, discount, unit, total amount, etc., as per your business requirement. Step:7 – To the right of the ‘Invoice To’ section, create fields like Invoice No., Date, Due Date, Terms, etc. Step:6 – In the next cell, create an ‘ Invoice To ’ field to enter customer details like name, company name, address, email ID and GSTIN/UN. Step:5 – In the next cell, enter your company details, including company name, address, email ID and GSTIN. Step:4 – Click on the ‘ Header & Footer ’ tab and give the header for the sheet as ‘ Tax Invoice ’.

Step:3 – Upload the company logo in the blank sheet by clicking on ‘ Insert > Picture ’. Step:2 – Remove the gridlines by clicking on the ‘ View’ tab and then unchecking ‘ Gridlines ’ in the ‘ Show ’ section. Steps to Create Invoice Template in MS-Excel

0 kommentar(er)

0 kommentar(er)